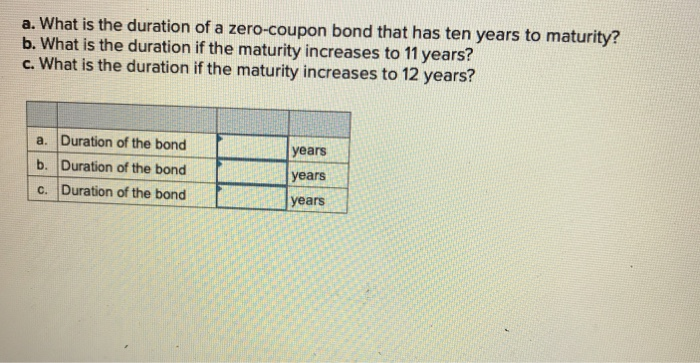

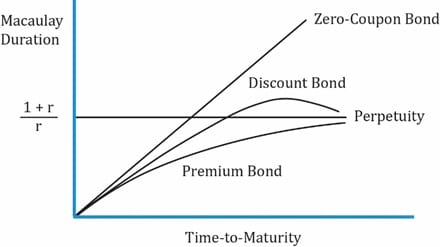

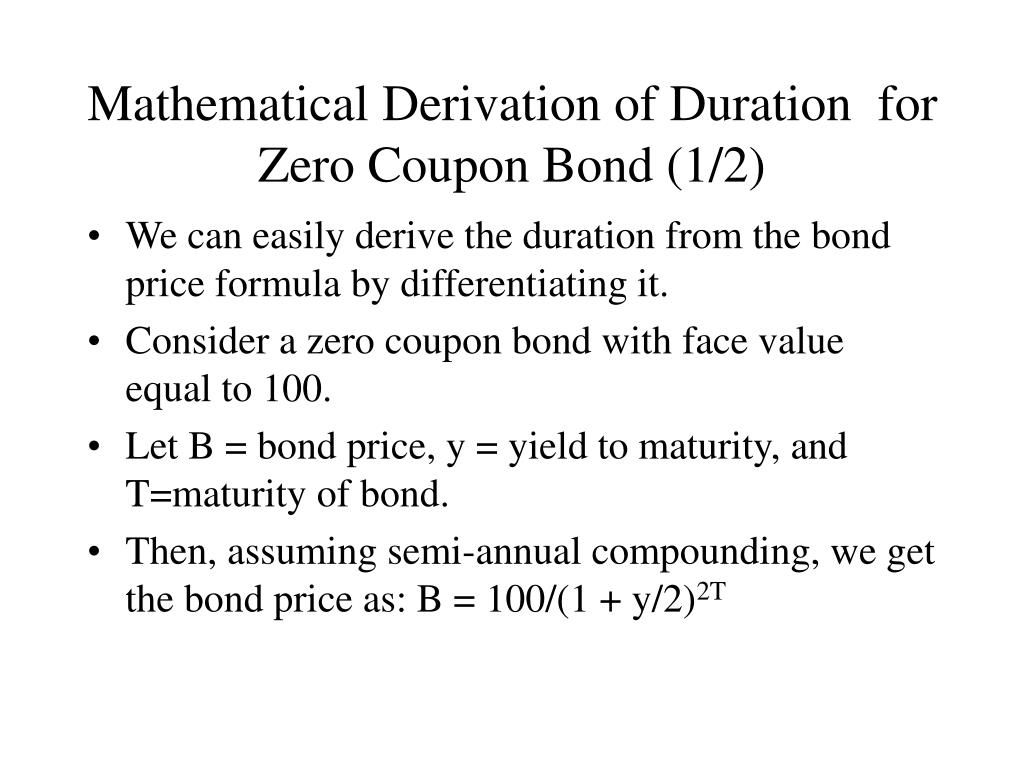

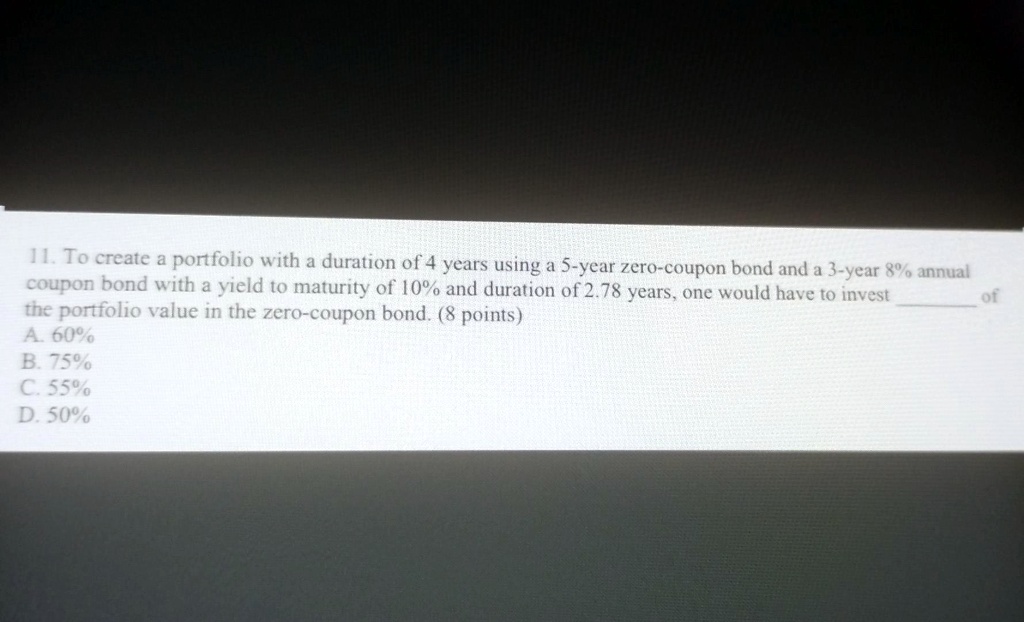

Interest-Rate Risk II. Duration Rules Rule 1: Zero Coupon Bonds What is the duration of a zero-coupon bond? Cash is received at one time t=maturity weight. - ppt download

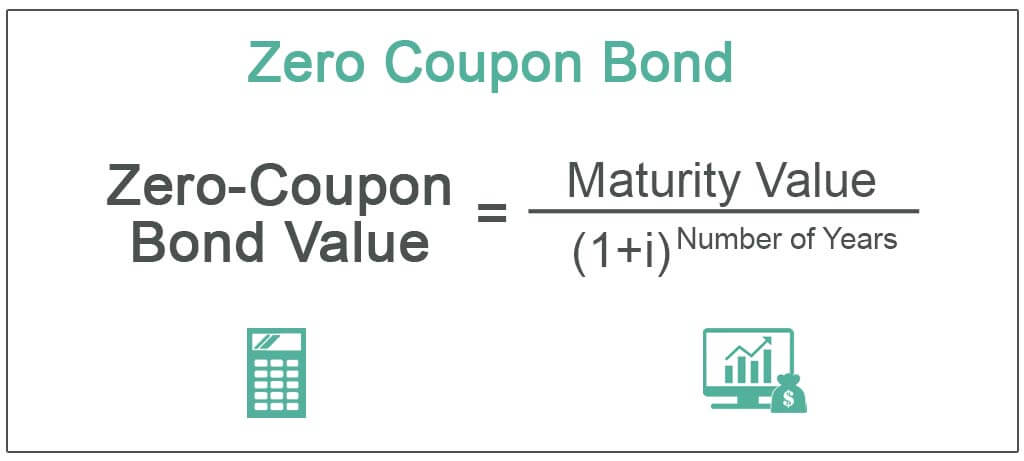

Price of a defaultable zero coupon bond price in each time t between... | Download Scientific Diagram

:max_bytes(150000):strip_icc()/Duration-2b4539d6fb9e4f4db07dc70a2e73bb01.jpg)