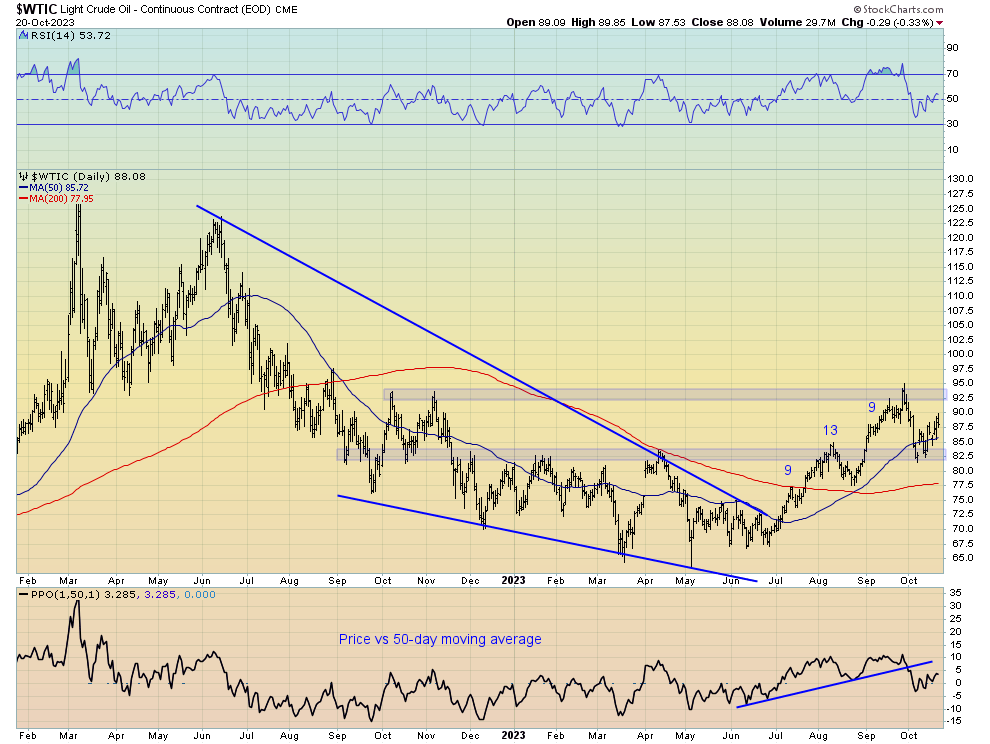

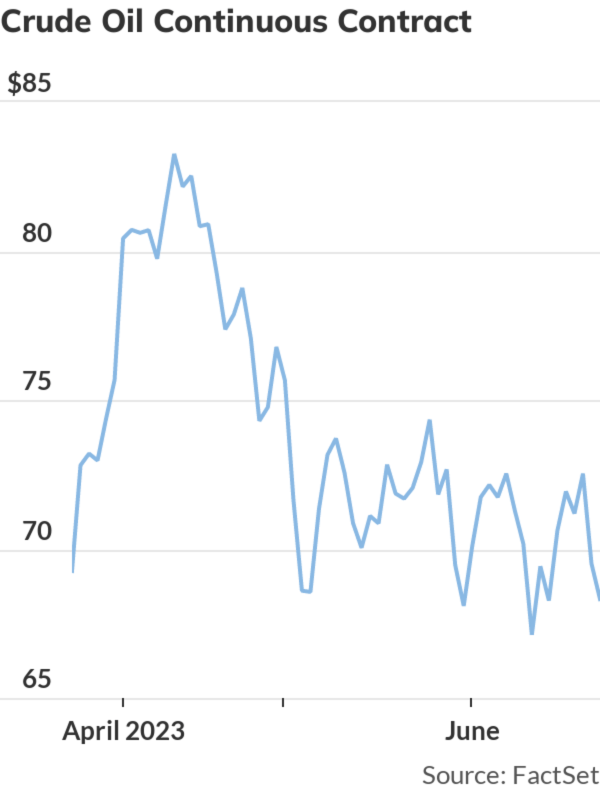

Momentum is Back, Breadth Rallies; It's Truth Time for OPEC and Crude Oil | Top Advisors Corner | StockCharts.com

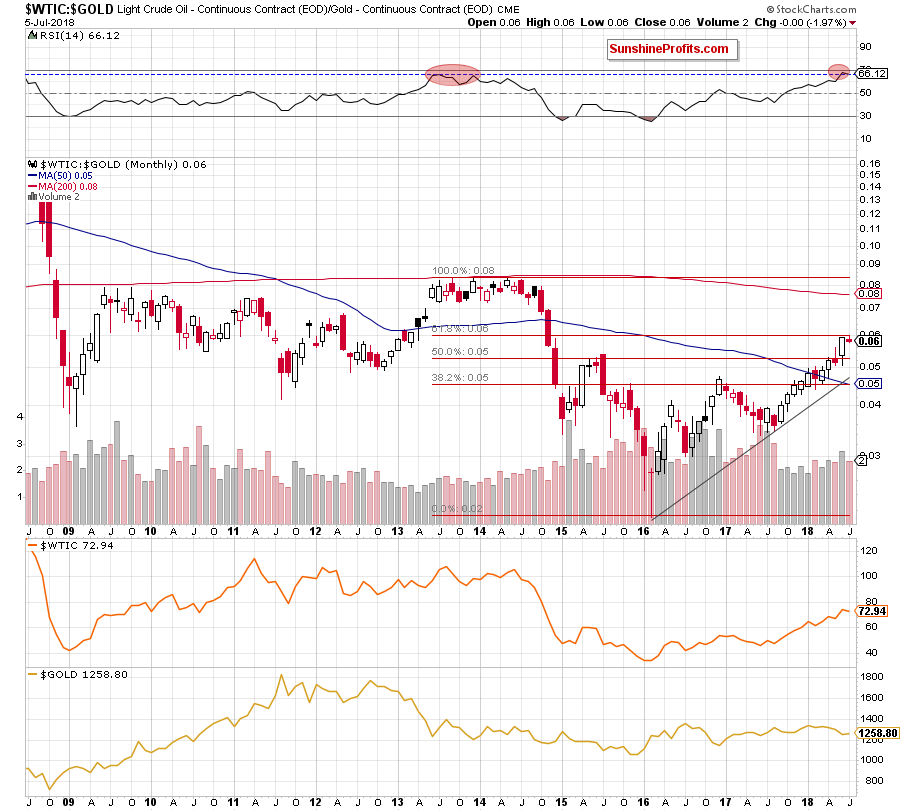

Gold Continuous Contract (GC.F) versus Other Currencies & Crude Oil Continuous Contract (CL.F) vs iShares US Oil & Gas Exploration & Production ETF (IEO) - SIACharts - Made for financial advisors.

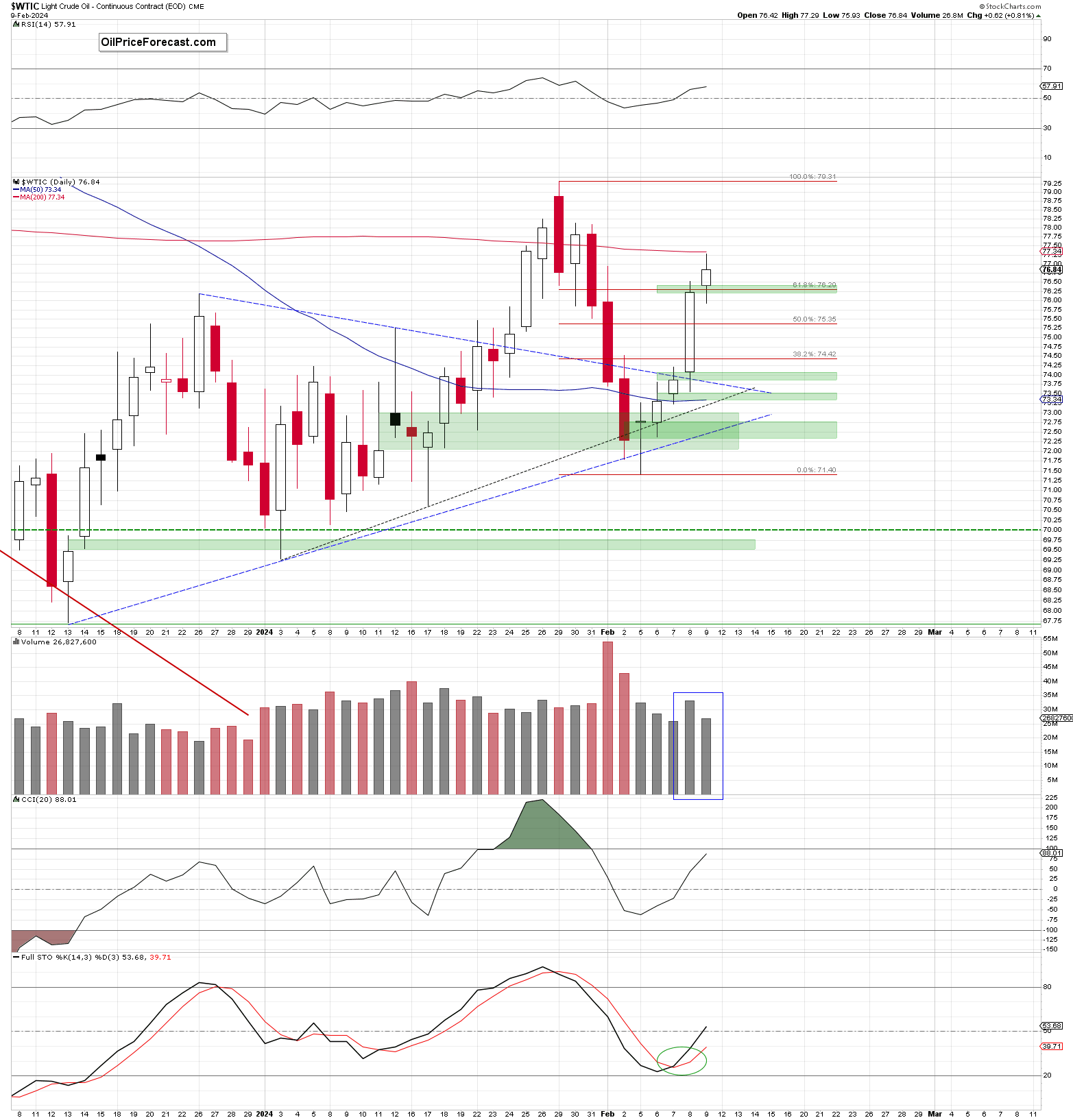

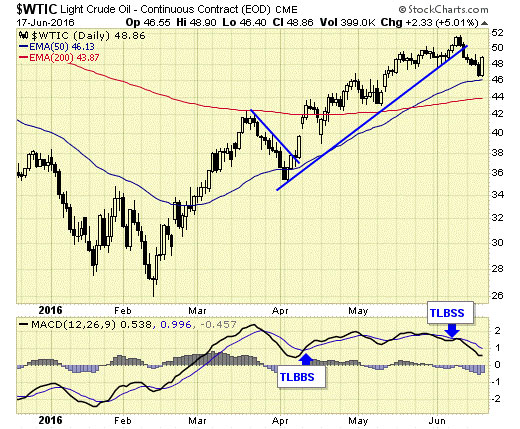

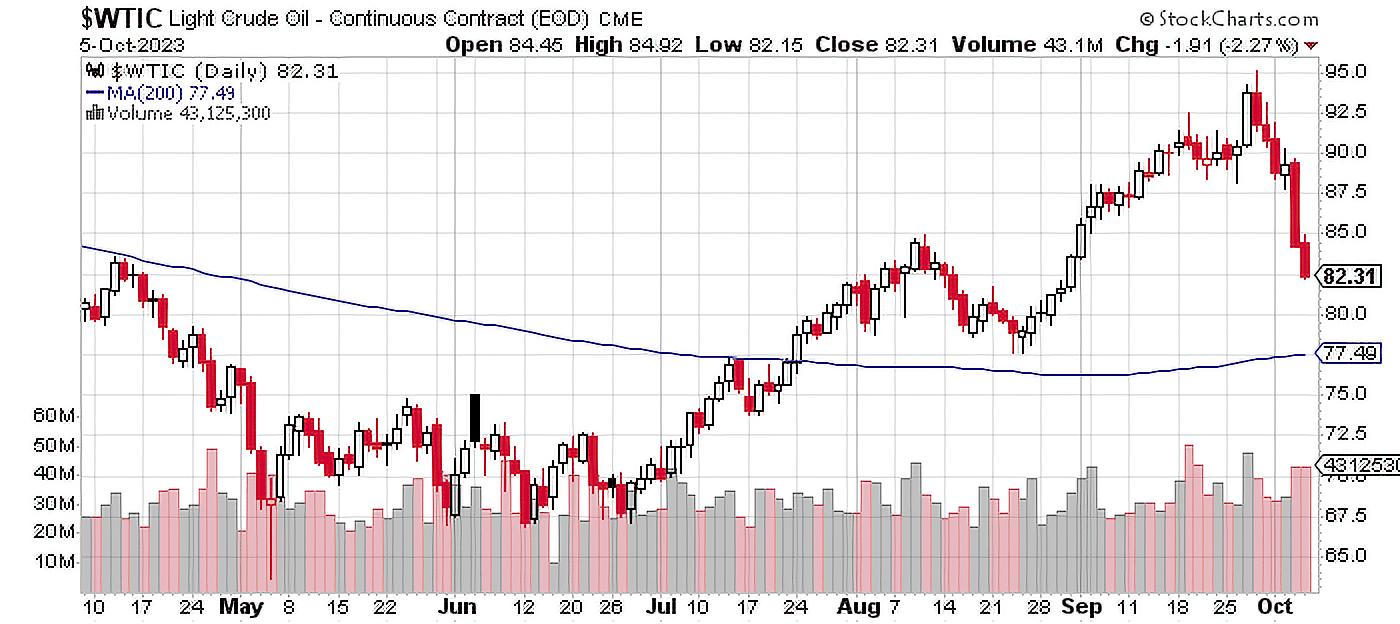

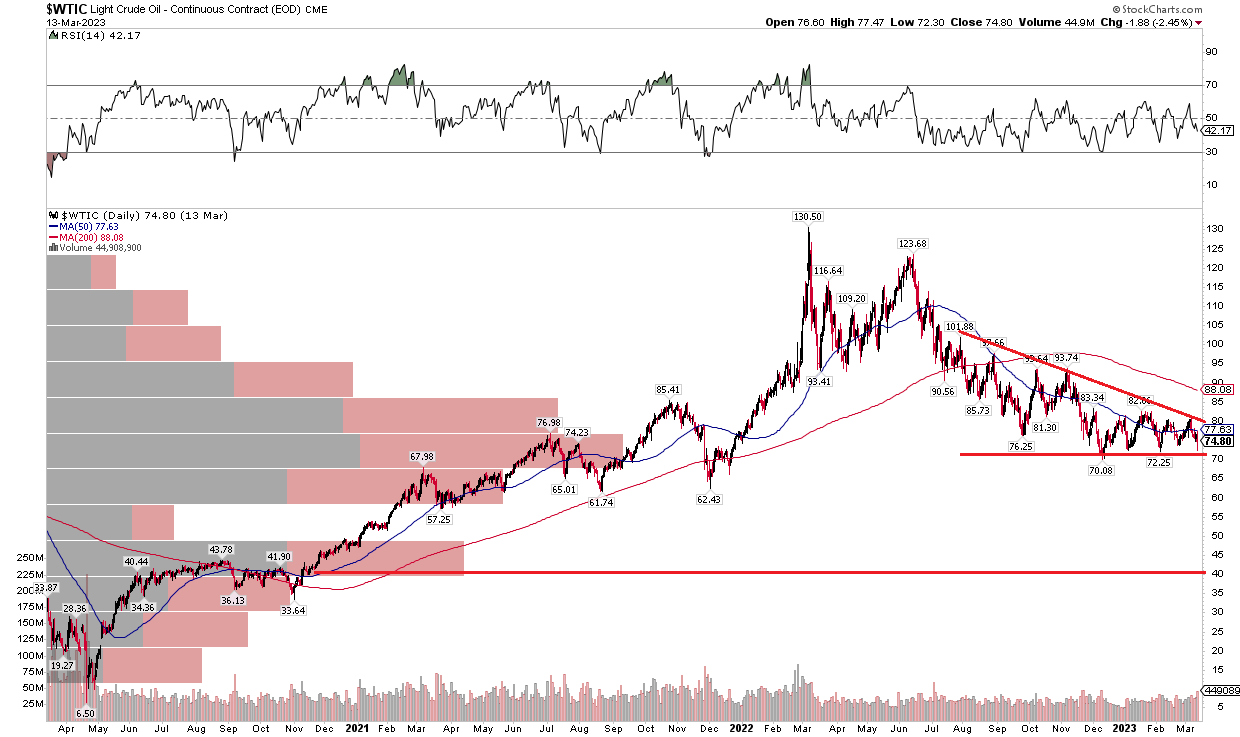

WTIC - Light Crude Oil - Continuous Contract (EOD) | Marketing data, Investment advice, Data services

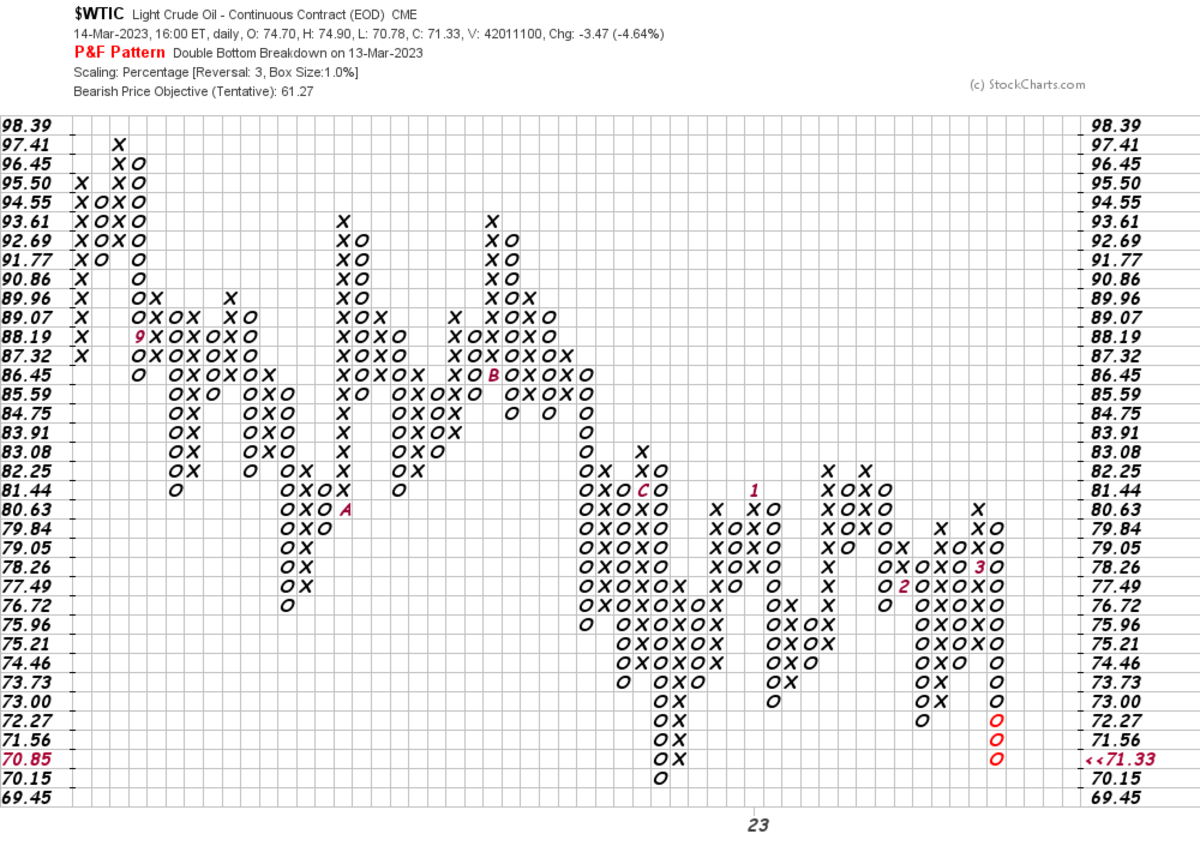

Invesco Oil ETF (DBO): Oil Prices On Verge Of Massive Downside Move (Technical Analysis) | Seeking Alpha