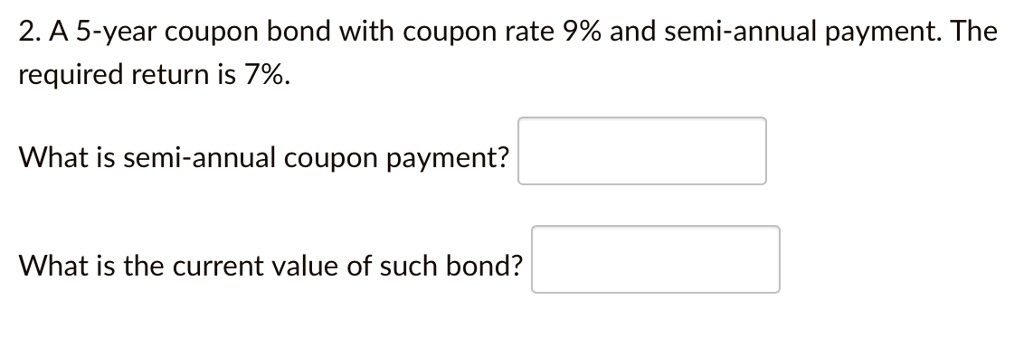

Solving for the semi annual coupon amount in Bonds related problems | Stocks and Bonds (Part 2) - YouTube

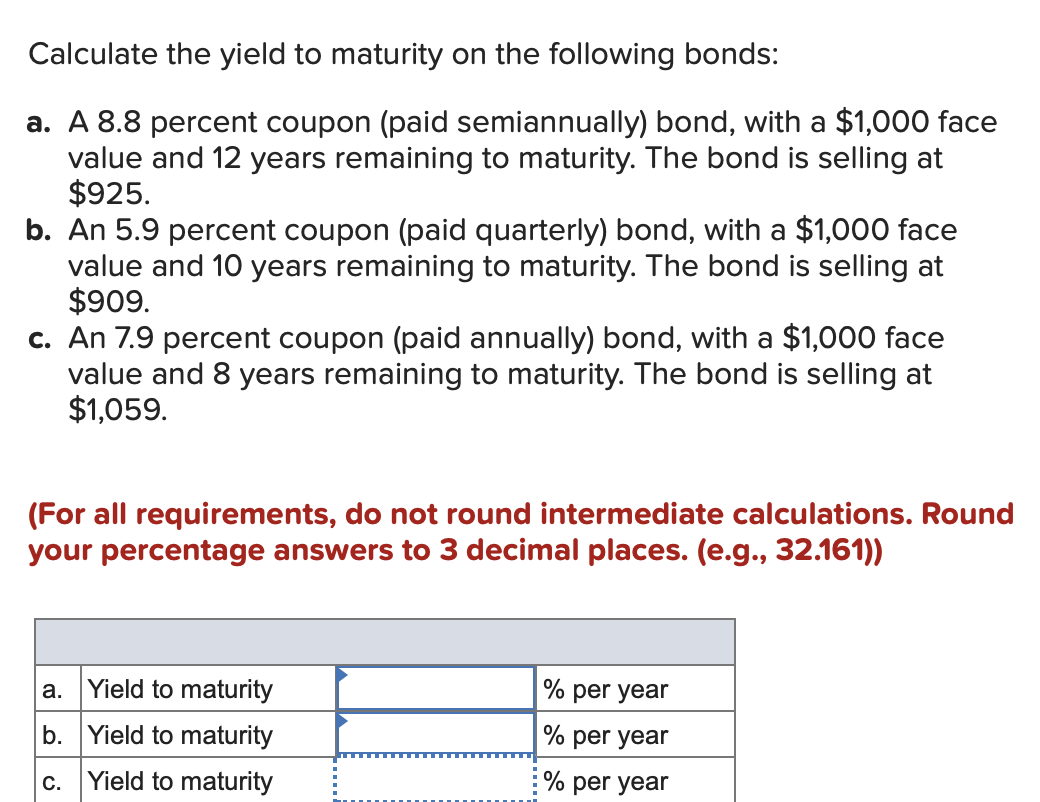

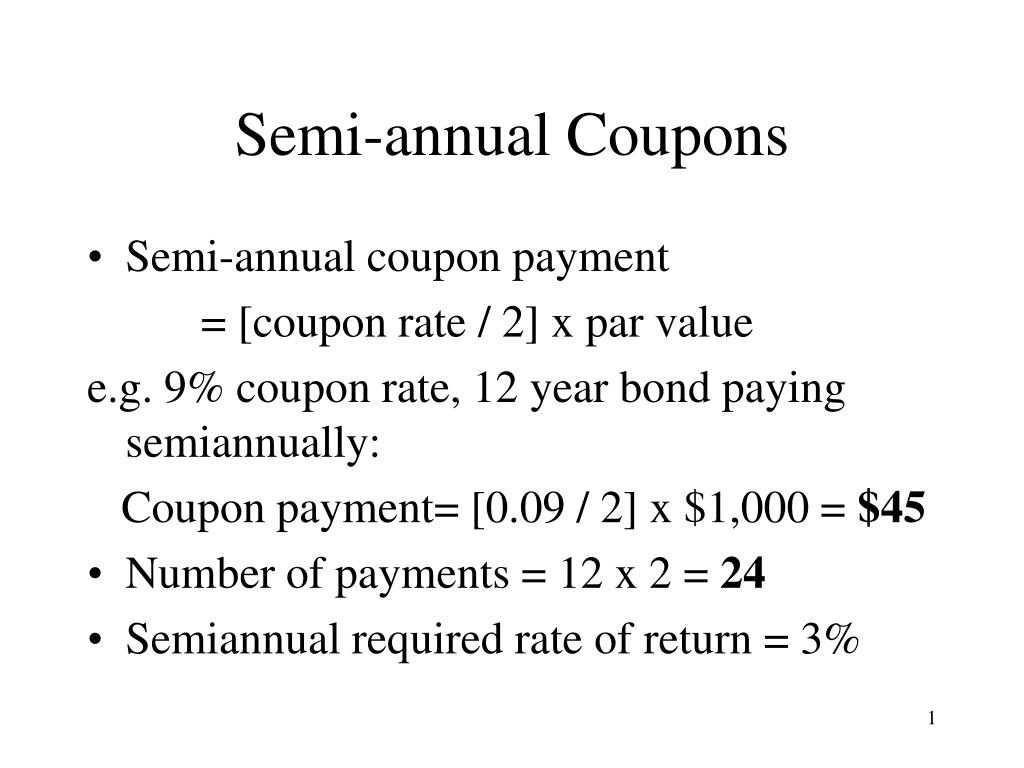

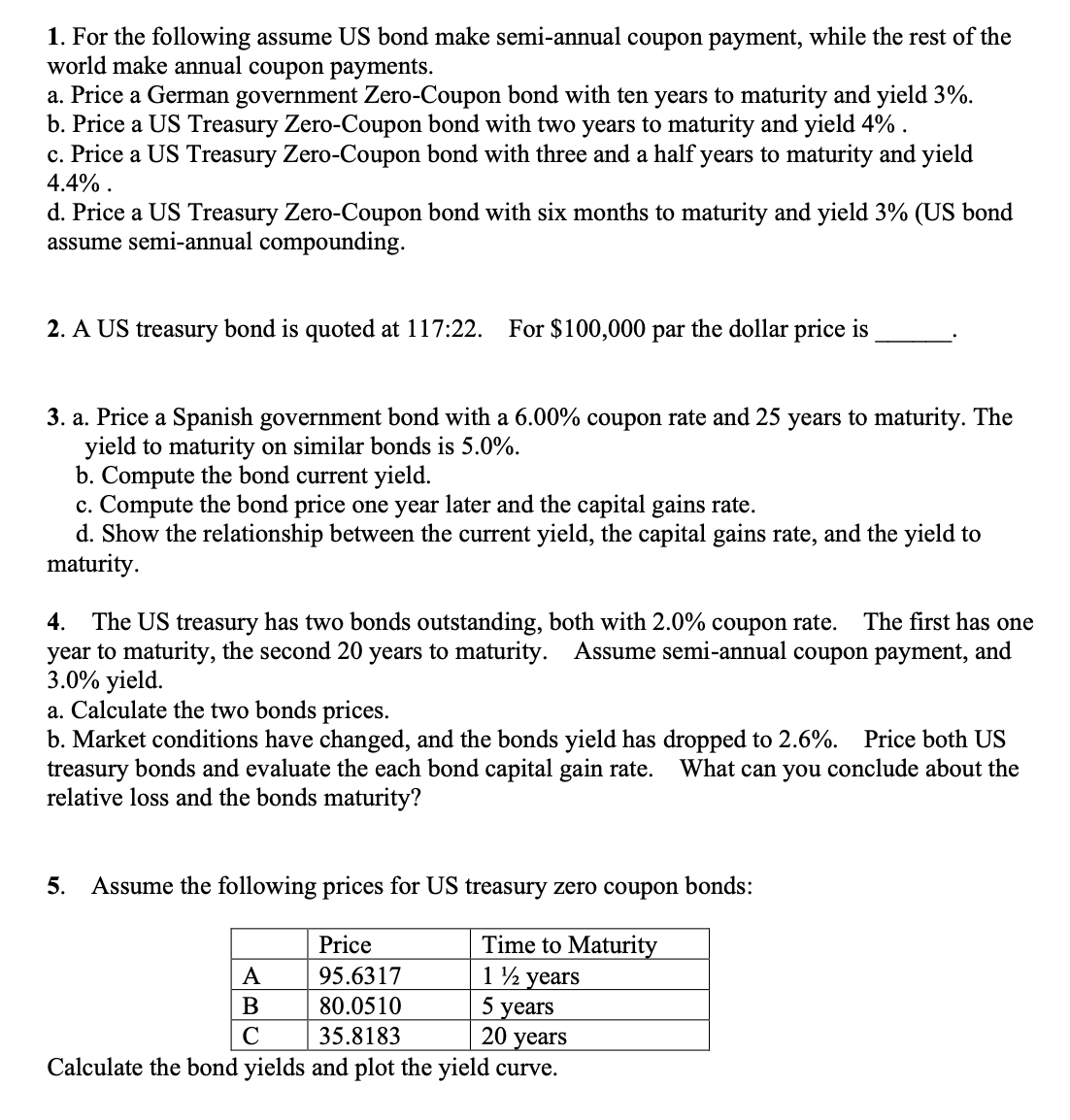

Consider a bond paying a coupon rate of 12.00% per year semi-annually when the market interest rate is only 4.8% per half-year. The bond has five years until maturity. a. Find the

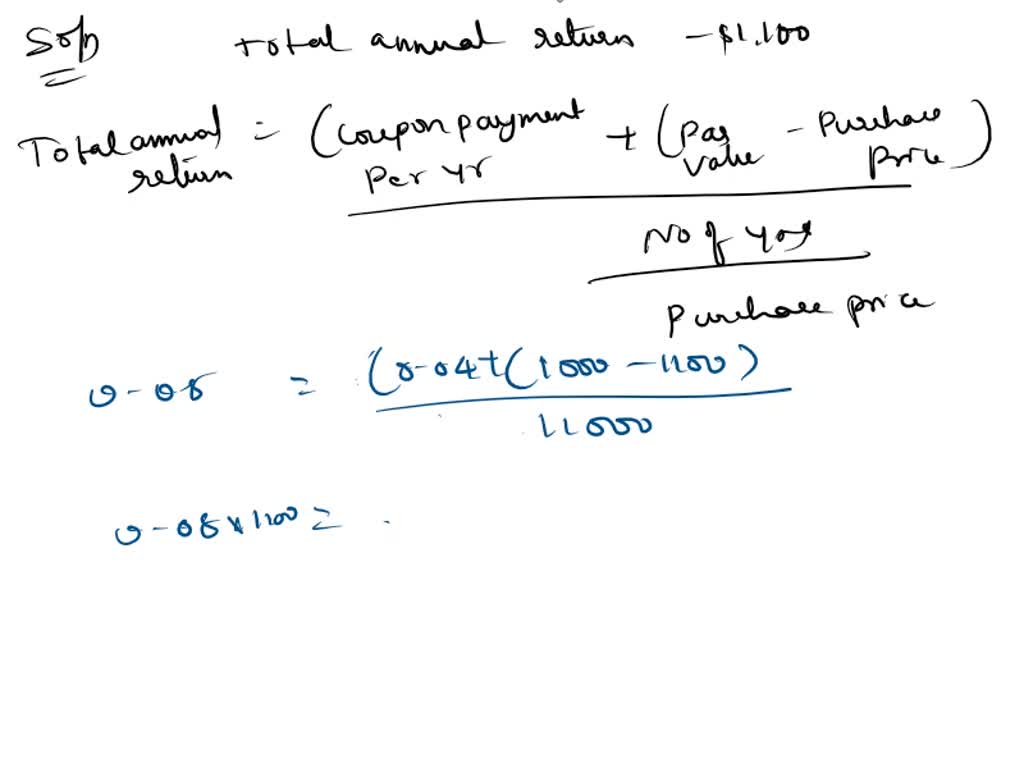

SOLVED: A 1000 bond bearing semi-annual coupons is redeemable at par. What is the minimum number of years that the bond should run so that a person paying1100 for it would earn

![Solved: Determine the amount of semi-annual coupon paid For a 3% bond with a Face value 0F 100, 00 [Business] Solved: Determine the amount of semi-annual coupon paid For a 3% bond with a Face value 0F 100, 00 [Business]](https://p16-ehi-va.gauthmath.com/tos-maliva-i-ejcjvp0zxf-us/bf7c30257f1a4306af931b39040cbb54~tplv-ejcjvp0zxf-gwm-webp-scale:1193:299.webp)

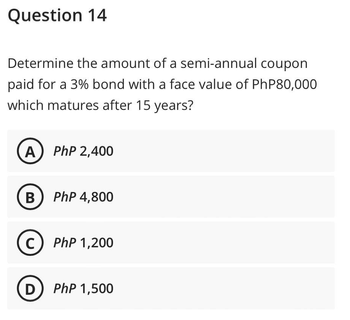

Solved: Determine the amount of semi-annual coupon paid For a 3% bond with a Face value 0F 100, 00 [Business]

A bond has a coupon of 6.5% and it pays interest semiannually. With a face value of $1000, it will mature after 10 years. If you require a return of 12% from